One Year of dTAO: The Market That Took Over Bittensor

Why Root yields collapsed and how to read the metrics that matter now.

My two-year-old just learned what gravity means.

He was standing on the couch, confident, giggling, acting like he’s Spider-Man as usual.

Then took one step too far. I caught him, obviously. But the look on his face was pure betrayal: Wait, you mean the ground isn’t always there?

That’s exactly how February 2025 felt for Bittensor holders.

dTAO launched, and suddenly the invisible floor we’d been standing on: Root staking, predictable yields, passive income, had vanished.

The pitch was simple: stop letting a handful of validators play God with emissions. Let the market decide instead. Turn every TAO holder into a venture capitalist.

And I fell for it.

Not the pitch. The promise.

I had the research and understood the mechanics.

I picked three subnets with real utility, spread a large share of my TAO across their alpha tokens and waited for the genius of decentralized markets to reward me.

Down only.

Not catastrophic. But watching your stack shrink while everyone screams about meritocracy hits different.

That’s when I realized this isn’t passive income anymore: this is the 2017 shitcoin era all over again, except everything’s priced in TAO instead of Bitcoin.

So when I tell you dTAO worked, I’m not talking about my personal portfolio.

I’m talking about whether the mechanism actually did what it promised: let markets decide which subnets deserve to exist.

The Promise vs. The Setup

Before February 2025, Bittensor had a centralization problem.

Root validators decided emissions and politics ruled.

dTAO was the solution: turn every TAO holder into a validator.

Each subnet issues its own alpha token. You stake TAO to support it and more emissions flow to that subnet.

The promise was simple: utility would win. The best subnets would rise to the top.

How it works: TAO is the reserve currency. Alpha tokens are subnet equity. Utility drives alpha price up. Failure drives it down—and eventually, deregistration.

Now let me show you what happened in practice.

The Reality: Three Stories

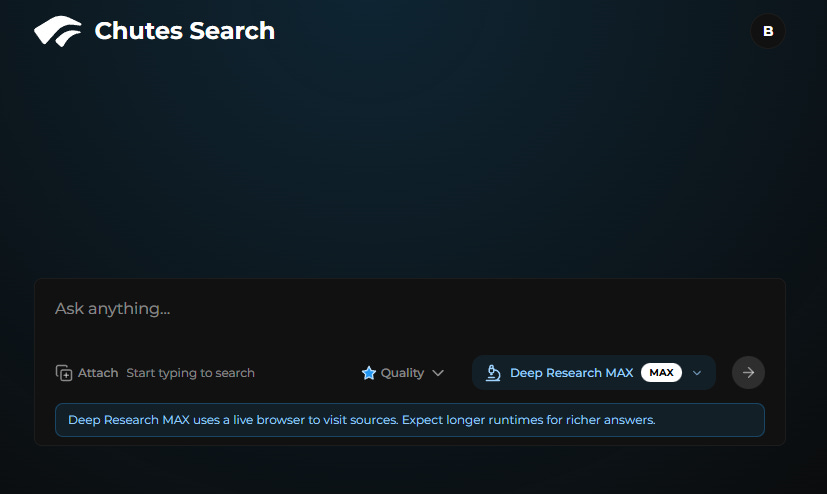

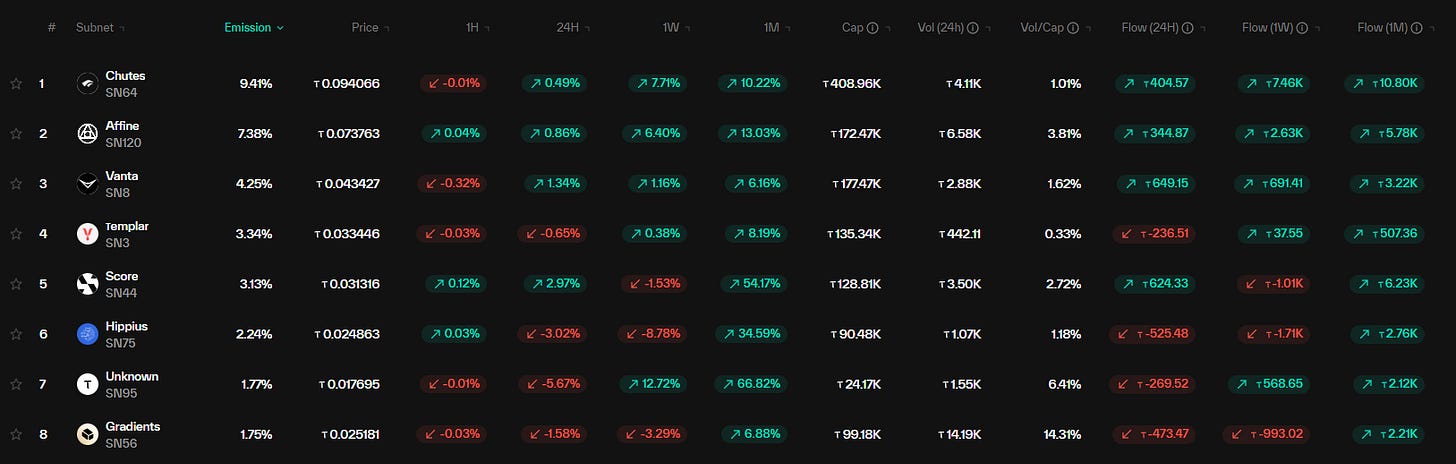

Winner: Chutes (SN64)

Chutes is a serverless AI inference powerhouse.

Pre-dTAO launch, it delivered practical compute that beat centralized alternatives on cost and latency.

Post dTAO it rapidly attracted massive staking inflows, securing top spot with 9.3% of network emissions and a market cap of $64M in February 2026.

The narrative: Utility + market signal = explosive growth.

dTAO rewarded real-world demand directly. No committee meetings or politics, just developers voting with their wallets because the service actually worked.

Loser: Tiger Alpha (SN107)

Tiger Alpha registered in June 2025 with an initial 200 TAO stake. It promised real-time, verifiable crypto market data via decentralized AI agents.

It failed to build traction. By December 2025, it pivoted branding to Knowledge Delivery Network (KDN-1).

Daily emissions peaked at 18 TAO, but no meaningful milestones materialized. It was deregistered in early February 2026 with 900 TAO returned to alpha holders.

The narrative: Lack of product-market fit + liquidity starvation = swift cull.

The market didn’t wait. No product or users means you’re out.

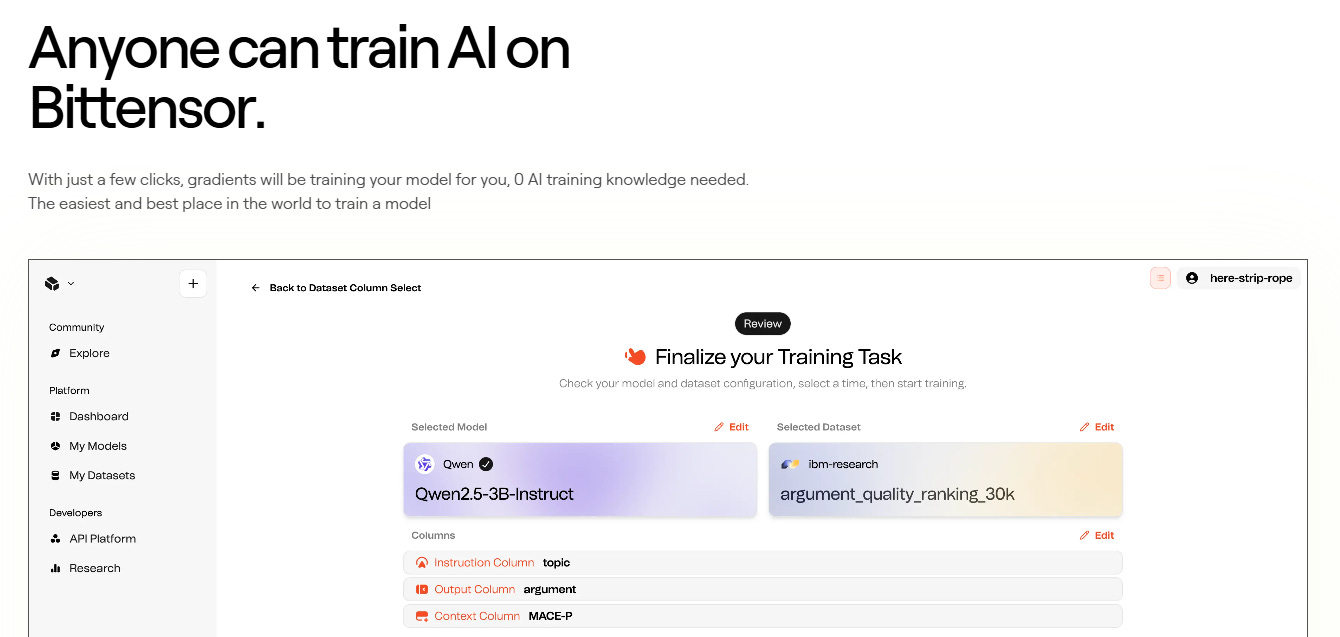

Survivor: Gradients (SN56)

“Anyone Can Train AI.”

Gradients democratizes AI training on Bittensor. It removes technical barriers, allowing you to simply upload data and select models while network miners compete to handle the training.

Registered pre-dTAO (November 2024), it survived the gauntlet: Taoflow, pruning, the cap and the halving. Steady performance at 2.5–3% emissions with consistent utility.

The narrative: Quiet utility + reliable staking inflows = resilience.

No fireworks. Just stayed in the game while the exit door got crowded.

Root Yield Collapsed, Forcing Alpha Migration

The original dTAO design promised something: you could stake TAO to Root (Subnet 0) and earn “risk-free” yields while the market sorted out which subnets deserved capital.

That theory lasted until the math caught up.

Post‑dTAO, TAO staked on Root is only counted at 18% of its nominal value in validator weight, while Alpha stakes are fully weighted.

As Alpha supply and subnet demand grow, this design shifts rewards away from Root and has already pushed Root APYs down from their pre‑dTAO highs into lower territory over the following months.

By late 2025, Root staking on average was barely beating inflation.

Investors had a choice: accept near-zero yields or migrate into higher-risk Alpha tokens.

The mechanism has forced capital allocation. If you want returns in a dTAO world, you have to pick winners. There’s no neutral ground anymore.

The side effect is retail TAO holders became involuntary venture capitalists, forced to research subnet fundamentals or watch their stack erode in real terms.

Note: This is where Subnet Edge helps—I use their independent market intelligence to stay current on subnet fundamentals without spending hours digging through data myself. Check out their publication here and read on for details on how to interpret the data so you can invest in subnets with confidence.

What It Means for TAO Holders

You’re a capital allocator now. Here’s how:

Track net TAO flows, not just price. The direction of capital tells you more than the alpha/TAO ratio.

Understand liquidity. Thin pools means volatile exits. Check depth before staking.

Unstaking hurts the subnet. Taoflow is bidirectional.

Your stake is a vote. Treat it seriously.

The dTAO Liquidity Checklist

Before staking TAO into any subnet, ask:

1. What’s the TAO pool size?

2. What’s the daily trading volume?

3. What’s the 30-day net flow direction?

Step-by-Step Screenshot Guide: dTAO Liquidity Checklist for Gradients (SN56)

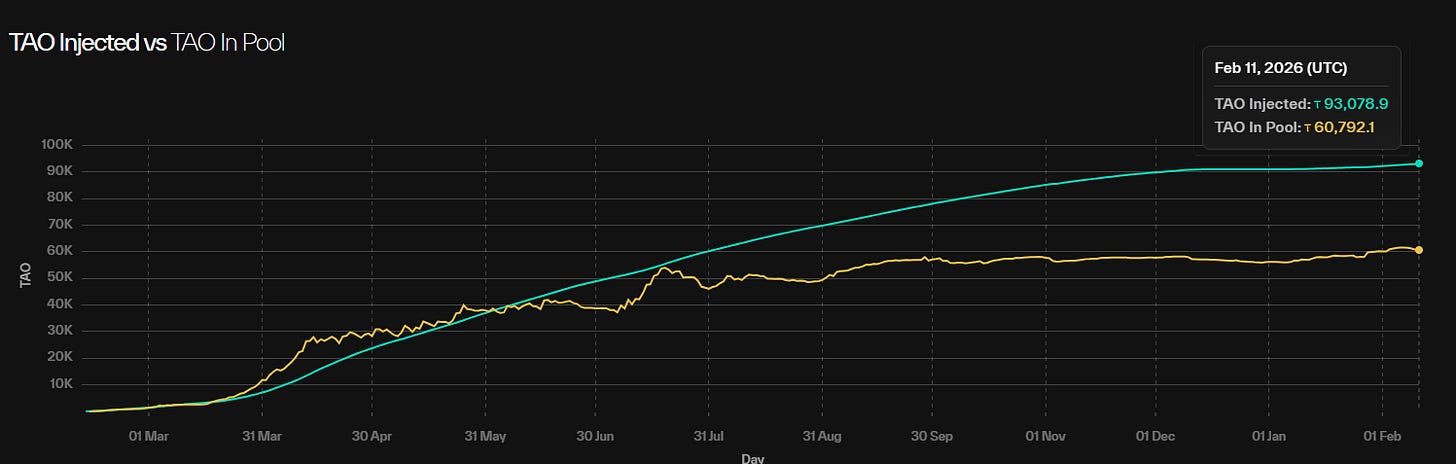

1. What’s the TAO Pool Size?

What it means: The amount of TAO available in the pool for trading the subnet’s token (Alpha).

Why it matters: High liquidity means you can buy or sell larger amounts with less price impact (low slippage). Low liquidity means even small trades can move the price a lot.

Step 1: Go to taostats.io/subnets/56/statistics

Step 2: Look for a section or card labeled “TAO in Pool”

This is usually near the top, in the main statistics area.

Interpretation:

This means there are about 60,780 TAO currently locked in the Gradients pool.

A higher TAO pool size generally means more liquidity, making it easier to buy/sell or stake without large price swings.

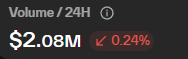

2. What’s the Daily Trading Volume?

What it means: The total TAO traded in the last 24 hours for this subnet.

Why it matters: High volume means lots of trading, so it’s easy to enter or exit positions and prices are more likely to reflect real demand. Low volume can mean it’s hard to find a buyer or seller and prices may be more volatile.

Step 1: On the same statistics page, look for “Volume / 24H” or similar.

Interpretation:

About $2.08mm of Gradients alpha was traded in the last 24 hours.

Higher daily volume means more active trading, which usually translates to better liquidity and easier entry/exit.

3. What’s the 30-Day Net Flow Direction?

What it means: Whether TAO is flowing into or out of the pool over the past month.

Why it matters: Positive flow means confidence is building. Negative flow means capital is fleeing. Under Taoflow, negative flow can zero out emissions entirely.

Step 1: Scroll down to the charts or history section of the subnet statistics page.

Step 2: Look for a chart labeled “TAO Injected vs TAO In Pool”, or similar.

Interpretation:

If the TAO in Pool is increasing over 30 days, more TAO is entering the pool (positive net flow).

If it’s decreasing, more TAO is leaving (negative net flow).

For Gradients, the TAO in Pool has been relatively stable with minor fluctuations, suggesting a balanced or slightly positive net flow recently.

How They Interplay

Imagine you’re at a currency exchange booth:

Liquidity is how much cash they have on hand.

Volume is how many people are exchanging money today.

Flow is whether their cash reserves are growing or shrinking.

A good booth (subnet) has plenty of cash, lots of customers and growing reserves. This makes it safe and easy to use.

Think of these three like the features of a busy marketplace:

A. High Liquidity + High Volume + Positive Flow

Like a major city market: lots of goods (liquidity), lots of buyers/sellers (volume), and growing trust (positive flow).

Result: Stable prices, easy trading and strong community confidence.

B. High Liquidity + Low Volume

Like a well-stocked shop with few customers.

Result: You can trade large amounts without moving the price, but it may take time to find someone to trade with.

C. Low Liquidity + High Volume

Like a small shop with a rush of buyers.

Result: Prices can swing wildly (high slippage) and trades may be harder to execute at expected prices.

D. Low Liquidity + Low Volume + Negative Flow

Like a quiet, small-town store with little stock and customers leaving.

Result: Hard to trade, prices unpredictable, and higher risk of getting zeroed out under Taoflow.

In Practice (for Gradients)

If Gradients has high TAO in Pool, high 24h volume, and positive flow, it’s a sign of a healthy, active and trusted subnet.

If one metric lags (e.g., high liquidity but low volume), consider how that might affect your ability to trade or stake efficiently.

Check the main Subnets page in taostats if you’re unsure how a subnet compares against its peers on these metrics:

The dTAO verdict

So did it work?

Yes. And that’s exactly the problem.

dTAO works. Markets are deciding. Capital is flowing to utility. The winners are winning. The losers are losing. Darwinian capitalism is doing its thing.

But if history has taught us anything about markets, they're never truly free.

As we settle into this new era, a controversial reality is setting in: First-Mover Advantage.

Early subnets keep better economics forever because their Alpha tokens started halving earlier. Every TAO halving creates permanent tiers. A 2024 subnet has better economics than an identical 2026 launch.

The bull case is straightforward: early risk deserves permanent reward.

The bear case is equally clear: this creates an entrenched oligarchy where innovation gets punished for showing up late.

The ecosystem hasn’t decided yet whether this is a feature or a bug.

But here’s what dTAO has proven: markets will force that decision faster than committees ever could. Either the mechanism adjusts to create fairer competition, or the next wave of builders goes elsewhere.

The experiment worked. Now comes the hard part: surviving it.

Until next time.

Cheers,

Brian

It seems to me that the subnet is starting to get greedy. They’re not even letting you out of the subject that we are charging you a high price I purchased score last night and I wanted to get out this morning and the lowest they had was .33 to get out. I tried to get out for over an hour and it seems to me the longer. I stay in the sub that’s the more they want to take off the top. I’m thinking of dumping the whole program. It’s a shame.

Great work Brian. The big takeaway for me is that dTAO replaced “passive yield” with forced capital allocation.

The hard part is that most retail holders are not devs. Keeping up with subnet fundamentals, taostats metrics, liquidity, and fast narrative shifts is a real job.

Your liquidity checklist is exactly the kind of practical filter people need to avoid treating alpha tokens like a 2017 roulette wheel.