The First Bittensor Halving: The End of Easy Mode

A field guide for scarce TAO liquidity across 100+ AI economies

I’ve been through this before.

As someone who watched the last two Bitcoin halvings unfold; first as a wide-eyed newbie, then as a slightly less clueless observer, I recognize the signs.

The hype builds like a storm on the horizon. YouTubers proclaim moonshots (“to the moon!”, “Your last chance for riches!”) and forums buzz with predictions as everything is going to so utterly change.

And what happens on the day?

Nothing dramatic at all.

The next block is mined, the online watch parties cheer and the chain keeps on producing new blocks with half the reward.

The price?

It stays flat and even decreases in the months following, excitement quietens and all the while the chain chugs along, blocks keep coming, and life resumes.

But give it 6-12 months and the real effects ripple out. Prices climb, narratives solidify, and the ecosystem matures.

Bittensor’s first halving is knocking at the door, projected for around December 15th 2025. It’s not Bitcoin’s simple miner payday slash.

This one touches over 100 AI economies at once, reshaping liquidity, incentives, and survival odds.

If you’re staking TAO or eyeing a subnet, this isn’t just an event. It’s the end of Bittensor’s easy mode.

Here’s your field guide to navigate when liquidity gets scarce.

Halving 101: Why this isn’t just “number go up”

Let’s “take a step back” as my old boss used to say when he tried to hide that he didn’t know what was going on.

Bittensor’s halving isn’t a carbon copy of Bitcoin’s. Here’s the core distinction:

What’s Being Halved?

Bitcoin (BTC):

Every 4 years, the number of new Bitcoins paid to miners per block is cut in half. If you mine, you get half as many coins overnight.

Bittensor (TAO):

Every 4 years, the amount of new TAO created per block is cut in half, which halves the TAO routed to subnet pools. It doesn’t immediately cut miner/validator rewards as that happens at each subnet’s own alpha halving (getting complicated already, isn’t it?).

How many tokens are involved?

Bitcoin:

One token (BTC). One halving schedule. Very simple.

Bittensor:

Main token: TAO (like “Bitcoin of the network”).

Each subnet has its own token: Alpha.

There are two kinds of halvings: TAO halving – global, every 4 years (this one), like Bitcoin’s. Alpha halvings – each subnet’s alpha supply halves on its own schedule (roughly every 2–2.5 years).

Practical effect:

Bitcoin:

New BTC entering the market is cut in half. Miners immediately earn half as many new BTC per block. This historically increases scarcity and often leads to big price cycles.

Bittensor:

New TAO entering the system is cut in half. Liquidity growth in subnet pools slows (TAO + alpha injections are halved). Rewards inside subnets stay the same until that subnet’s alpha halving. This makes TAO scarcer and makes new subnets slower/harder to bootstrap liquidity.

What the Bittensor halving actually is (in human terms)

TAO follows Bitcoin’s emission curve: 21M cap, halvings every 4 years. When we hit the first 10.5M in circulating supply, daily rewards drop from 7,200 to 3,600 TAO.

This halves injections (TAO + alpha flowing into subnet pools), not emissions (alpha paid out to miners/validators/owners).

Network inflation drops from 25% to 12.5% annually on the 21M curve.

What changes?

Liquidity Thins Out: Pools deepen slower. New subnets need twice as long to build depth, giving pre-halving subnets an edge.

Volatility Spikes: Shallower pools mean bigger price swings on sells. Effective sell pressure intensifies. Miners cashing out alpha could tank thin markets.

Scarcity Kicks In: Less TAO is minted overall. If demand (from staking, new subnets) holds, this could amplify TAO’s value as the network’s monetary primitive.

Incentive Pressure Builds: With less “free” liquidity, subnets must prove real utility to attract miners and capital. No more masking inefficiencies with emissions.

The halving should not directly change subnet prices; TAO injections are liquidity, not a price subsidy. Every halving both strengthens TAO scarcity and forces more precise incentive design because there’s less TAO to misallocate.

The Supply Shock vs The Miner Squeeze

This is the most direct impact: scarcity versus sustainability.

The Bull Case: Lower block rewards reduce sell pressure from miners and validators who often sell to cover operational costs. If demand remains stable or rises due to the AI narrative, this supply shock could drive price appreciation.

The Bear Case: Subnets face tighter liquidity just as they need to attract and retain compute. Rewards inside subnets don’t halve at TAO halving; pressure comes from thinner pools, worse slippage, and slower bootstrapping.

For the network to survive the halving without a price increase, miners must become twice as efficient, or the price of TAO must double to maintain the same level of incentive in dollar terms.

This is the efficiency wall the ecosystem must climb.

The Quality Filter

Think of the halving as subnet Darwinism.

In a high-emission phase, inefficiencies can be masked by abundant rewards. When rewards are cut in half, subnets that aren’t producing real value and attracting real demand will struggle to retain high-quality miners.

Only the subnets generating real-world utility will thrive when the easy money tap is turned off.

For subnet owners

Post-halving, bootstrapping becomes harder as liquidity injections are halved and new subnets are born thinner and more volatile.

Product market fit needs to be found in weeks, not months, or miners and speculators rotate to deeper pools.

External revenue becomes highly important (paid inference, data licensing, etc.) so miners aren’t 100% dependent on emissions.

Alpha holders need to be explicitly incentivized otherwise alpha drifts toward zero over time.

The halving pushes subnet owners to behave more like real CEOs with customers and revenue and not just farm emissions.

For miners

Rewards inside subnets stay the same until the alpha halving, but risk rises because pools get shallower. Margins hinge on alpha price performance and illiquid subnets can nuke miner profits when alpha tokens sell through thin order books.

Expect migration toward deep TAO-backed pools and subnets with clear business models and external revenue.

Every halving both tightens TAO’s scarcity and coincides with better price discovery and more mature subnets, so the “scarcity × usefulness” story strengthens.

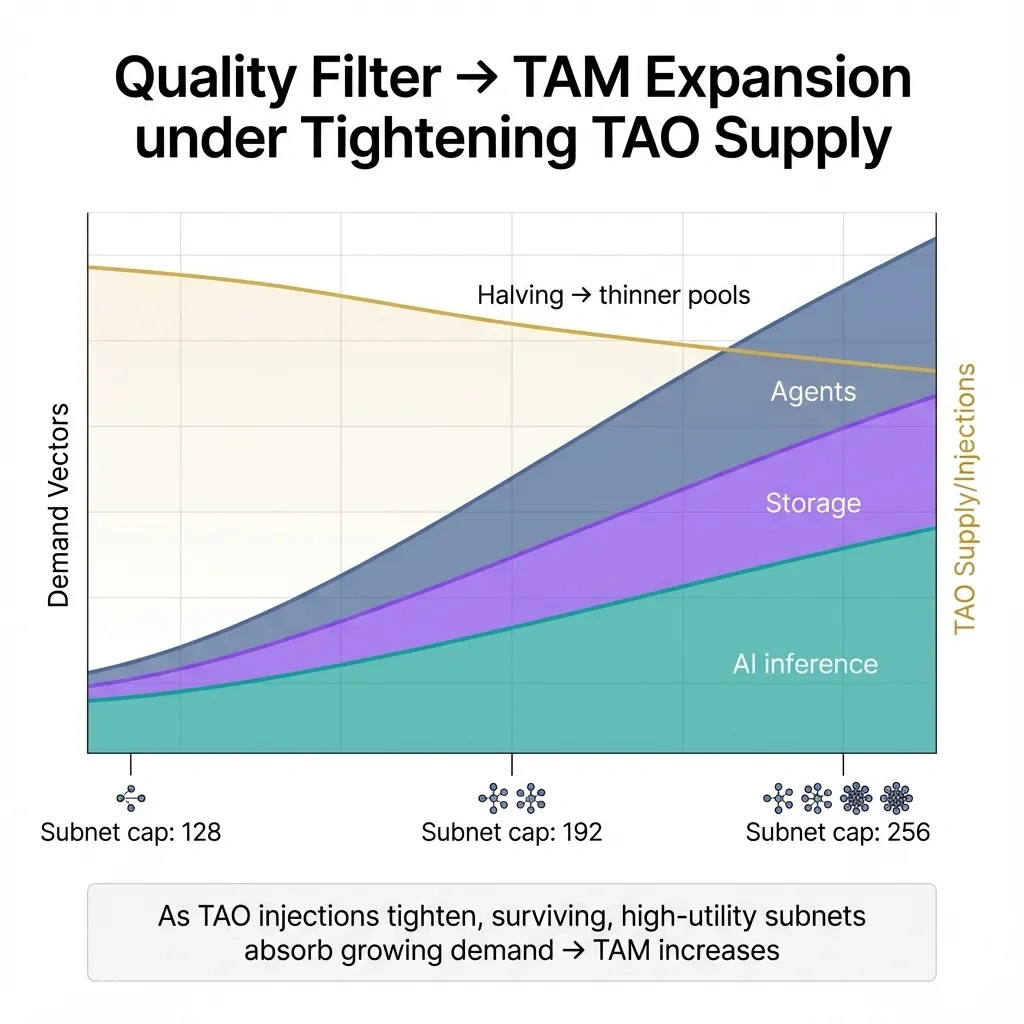

Layer in future subnet cap changes and growing demand vectors (e.g. AI inference, storage, agents) as TAO supply tightens and you see the potential for increasing Bittensor’s total addressable market (TAM).

Designing Incentives in a Post‑Halving World

Bittensor acts as an incentive mechanism language where subnets program custom proof‑of‑useful‑work.

Alpha acts like permissionless equity: open to anyone who can win the competition, with no hiring or vesting. The moat is unforkable miner communities, not just code.

Here’s a simple Post-Halving Incentive Checklist for subnet owners (and what I’ll examine in future spotlights).

The Post‑Halving Incentive Checklist for subnet owners:

Measure: Is your commodity precisely measurable enough that miners can’t game it easily? If not, value leakage will be brutal as TAO gets scarcer.

Align: Does alpha accrue real benefit to long‑term holders, not just transient miners?

Diversify: Can a profitable mechanism subsidize an experimental/open‑source one under a single token, like corporate R&D?

Onboard: Is the path from “curious dev/miner” to “earning” under a month? If not, you’ll struggle to attract the global talent Bittensor makes available.

Micro‑Checklist for miners:

Prefer deeper pools and monitor slippage before cashing out alpha.

Track upcoming alpha halving dates and reprice risk.

Favor subnets with external revenue or paid endpoints.

The Fair Launch Legacy

Bittensor is following the Bitcoin playbook: no VC funding, no pre-mine and a fair distribution model.

In a crypto AI sector filled with insider allocations, the halving reinforces TAO as a monetary primitive for AI. It solidifies the long-term vision of a 100-year emission schedule rather than a short-term cash grab.

I’m not calling moonshots, but halvings mark turning points.

For beginners: watch how subnets adapt as this reveals winners.

For investors: Pair scarcity with growing TAM.

If you’re in a subnet, run the checklist. If you’re observing like me, track liquidity metrics post-event.

The halving is Bittensor’s maturity test. It marks the transition from the bootstrapping phase to the execution phase. And it pays to keep a close watch as the real impacts unfold over time.

What’s your halving take? Bull, bear, or wait-and-see? Hit reply as I’d love to feature community predictions in a follow up.

Until next time.

Cheers,

Brian

Great read! I am long term bullish on TAO. It is a great project but has to mature in my view in terms of token utility and subnet interaction/composability to achieve the desired network effects. Also, the forthcoming AGI revolution is in its favor I believe.

Nicely done. Very informative.