The Apprentice: Bittensor Edition

How Bitstarter is Auditioning the Next AI Unicorns

A certain boardroom keeps replaying in my head.

Not the stale ones with PowerPoint and cold coffee: the one with dramatic lighting, tension, and a theme song that signals impending doom.

Of course, I’m talking about The Apprentice.

Donald Trump sitting at the head of the table, looking at a team that just failed to sell lemonade, and delivering the two most famous words in reality TV history: “You’re fired.”

It was brutal and entertaining in equal measure, and it was the ultimate high-stakes job interview.

Little did I know, years after the show finished, I’d find the exact same dynamic playing out in decentralized AI.

In the world of centralized tech, you have to please a CEO to keep your job. In the world of Bittensor, you have to please the incentive mechanism. The market that pays only for useful work.

If your subnet doesn’t produce value? If your miners aren’t performing? If you lose your emissions slot?

You’re fired- Deregistered.

Quick glossary for new readers:

TAO: Bittensor’s native token used to route value across the network.

Emissions: Newly minted TAO distributed to subnets based on performance.

Immunity window: A grace period for new subnets (currently 4 months) before poor performers can be deregistered.

Before you walk into that boardroom to face the music, you need a business plan, a team and enough capital.

That is where Bitstarter comes in.

The Casting Call: What is Bitstarter?

If the Bittensor mainnet is the boardroom where you fight for survival, Bitstarter is the casting call.

It is the missing link between “I have a great idea for decentralized AI” and “I am running a top-performing subnet.”

Bitstarter (bitstarter.ai) is essentially Kickstarter meets Y Combinator, purpose-built for the Bittensor ecosystem. It solves a massive bottleneck that I’ve written about before: onboarding is too hard, and the cost of entry is too high.

Right now, if a team of brilliant AI PhDs wants to launch a subnet, they need GPUs, compute, and a runway of 6 to 12 months before they see a return.

If they don’t have deep pockets or VC connections, they die in the immunity window, the grace period before deregistration kicks in.

Bitstarter turns the funding model upside down. Instead of selling 25% of your company to a VC to buy GPUs, you:

Crowdfund the subnet launch directly from the community (TAO holders).

Keep 100% of your equity and get paid in emissions.

Build a community of backers before you even write the first line of mainnet code.

The F1 Pit Stop

The team at Bitstarter describes their process as an “F1 Pit Stop.”

When a car comes into the pit, it’s chaotic, but in seconds, it gets new tires, fuel, and adjustments, allowing it to fly out and hit the track at maximum speed.

Bitstarter does this for subnet builders. It injects teams with the capital, the marketing, and the technical advice they need so that when they finally launch on mainnet, they hit the ground running rather than stalling out.

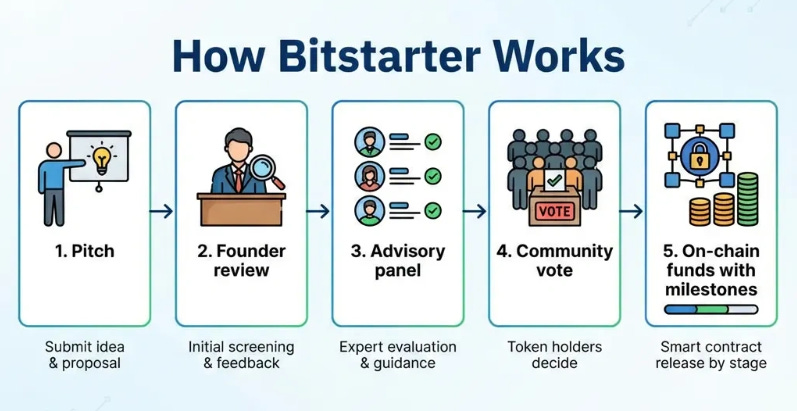

The Vetting Process: No Free Rides

This isn’t a free-for-all. You can’t just walk in and ask for money. Just like the show, there are layers of scrutiny.

1. Internal Team Up-skilling:

Teams submit their white papers, and the Bitstarter founders (experienced builders) tear them apart (constructively). Out comes a tighter executive summary and an investor‑ready pitch.

2. The Advisory Panel:

This is the Board of Directors. The proposal goes to a panel of protocol pros who check the math. Is the incentive mechanism gameable? Is the commercial model viable? This keeps bad actors out.

3. The Community Vote:

Finally, the project lands on the platform. This is where we come in. TAO holders browse the details, ask questions in Reddit-style threads, and pledge tokens.

It is participatory economics. There is no Donald Trump making the final call. The community is the boss.

Funds are then secured on-chain and released in tranches when teams hit pre‑agreed milestones.

The Contestant: AlphaCore (Subnet 66)

Every season of The Apprentice has a star contestant. In this first episode of Bitstarter, that contestant was AlphaCore.

Imagine a candidate walking into the boardroom and saying, “I can automate the entire DevOps pipeline so engineers never have to configure a server again.” That’s AlphaCore.

DevOps is a nightmare of high costs and repetitive tasks: configuring tools, testing deployments, chasing bugs. Everything needed to get developers code into production without it all falling apart.

Instead of hiring expensive engineers to manually manage this chaos, AlphaCore uses AI agents to do it automatically.

Miners become these agents, competing to set up the infrastructure perfectly every time and turning DevOps into a decentralized, incentive-driven market.

The Pitch: AlphaCore aimed to raise 440 TAO via Bitstarter.

The Deal: They offered 116,640 Alpha tokens (50% of owner emissions) in return.

The Result: “You’re Hired.” The community looked at the pitch, looked at the team, and instead of firing them, they fully funded the raise in just 4 days. 440 TAO raised from over 100 unique contributors.

The Art of the Deal: Why it Worked

Why did this work? Everyone loves a good deal, and strong alignment.

1. The Discount: Investors got in at 0.00377 TAO per Alpha token, an immediate 24% paper gain on day one based on market rates.

2. Skin in the Game: The founders locked their emissions to align incentives with the community. They only get paid if the project works.

3. High Energy: The launch wasn’t a boring lecture. The X Spaces hosted by Chris Zacharia (Macrocosmos Director) and Max Sebti (Score CEO) created hype, urgency, and a sense of “being there” that crypto thrives on. They covered roadmap, risk, and real milestones.

A Simple Framework: How Bitstarter Fits Your Role

If you’re reading this, Bitstarter matters to you in three ways. Here is your framework.

As a Builder:

Use Bitstarter when you have a clear problem and a capable team, but you lack the capital for GPUs or initial runway. It buys you time, capital, and credibility to survive the boardroom.

Action: Draft a one‑page executive summary and a 6‑month milestone plan before you pitch.

As an Investor:

Evaluate Bitstarter projects with three questions:

Is the commodity clear (e.g., deepfake detection)?

Is Bittensor actually a superpower for this idea vs Web2?

Is there a credible path from emissions to revenue?

Action: If all three are “yes,” size a small pledge tied to the first milestone.

As a Community Member:

Even if you never fund a project, you should care. Better subnets mean more TAO demand. Bitstarter is replacing the opaque world of VC term sheets with transparent, on-chain incentives. It strengthens the flywheel of capital, compute and talent.

Action: Join the project threads and ask one practical question (about incentive design or milestones) per pitch.

Who Survives the Cut?

I’ve ranted before about Bittensor’s onboarding problems. It’s been a black box for too long.

Bitstarter is the sledgehammer breaking that box open. By making participation as easy as a Kickstarter pledge, it turns the hurdle of ‘How do I code a miner?’ into a simple act: backing a vision.

Bittensor is the hardest boardroom on earth. There are no golden parachutes here. But Bitstarter gives these teams the preparation they need to survive the first meeting.

Stay tuned: I’ll look to cover the next Bitstarter raises, their milestones, and whether they deserve your TAO.

Until next time.

Cheers,

Brian

How do I join as an investor? My long term goal is to learn to be a Subnet Founder/Builder. Learning via becoming an investor first appears to be my best path. Thank you. Michael McKay