Bittensor's Relegation Zone: How to Save Your Subnet from Deregistration Before the Halving Hammer Falls

A Deep Dive into HappyAI (SN103) Vital Signs and Rescue Roadmap

I’ve been knee-deep in the Bittensor ecosystem for a while now, and every time I think I’ve got a handle on it, something new throws me for a loop that’s not even related to my struggles installing the Bittensor CLI.

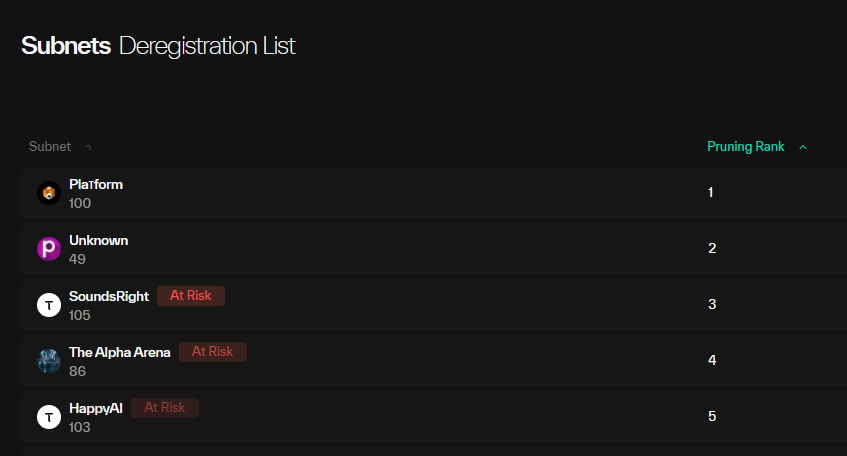

This leaderboard has been consuming my mind:

The deregistration list, or relegation zone, where no subnet wants to be.

The cap is back, the axe is sharp and the first network wide issuance halving is projected for December, reducing daily TAO issuance by 50%.

If you’re in the relegation zone, you have weeks, not quarters, to fix value signal, user friction and distribution.

Here’s how deregistration actually works, why halving tightens the vice and a 30‑60‑90 plan any at‑risk subnet can run.

Understanding Bittensor’s Deregistration: Survival of the Fittest

As of November 2025, Bittensor caps its active subnets at 128 slots: no more room at the inn.

When a new subnet registers after its immunity window, the lowest‑performing non‑immune subnet by emissions share is first in line to be evicted.

In practice, new registrations or returning paused slots trigger a rolling “last one in, last one safe” musical chairs where the bottom of the leaderboard is always at risk.

Deregistration resumed in October 2025 after a summer pause, with the first removal hitting SN100 mid‑month. New subnets currently get a 4‑month immunity period to build momentum; after that every registration event can push someone off the edge.

The underperformer label isn’t arbitrary: it’s tied to emissions, your share of network TAO rewards proportional to perceived value (validator weights, usage, and market demand routed through the incentive function).

Low emissions? You’re at risk.

Think of it as Bittensor’s version of natural selection: subnets must attract miners, validators, and users to earn their keep, or they make way for fresh blood.

This is great for innovation. It creates an existential threat that pushes teams to build better, as the OpenTensor Foundation puts it.

But it also risks axing hidden gems before they can shine.

And the upcoming halving amplifies the risk: with network issuance dropping by half in December, low‑emission subnets will see absolute rewards shrink while competition for stake and users intensifies. If you’re barely treading water now, the current will double.

The Marketing Blind Spot

I’ve written before about Bittensor’s communication gap. For this piece, let’s keep it simple: if a normal user can’t repeat your value in 10 seconds and try it in 60, your emissions will reflect it.

Deregistration will force clarity or death. Here’s the playbook I’d actually run.

The VITALS + RALLY framework: a 10‑minute diagnostic and a 30‑60‑90 rescue plan

VITALS: 10‑minute “Vital Signs” diagnostic (pass/fail thresholds)

Value signal (10s pitch)

Pass: A non‑technical user can repeat your value in one sentence without jargon.

Fail: Requires explaining TAO/mining/validators to make sense.

Interface (60s try)

Pass: A new user can hit a live demo/API or product page and get a useful result in under 60 seconds.

Fail: Wallets, docs, or Discord are required just to try.

Traction

Pass: Emissions share ≥0.20% or 30‑day positive delta; ≥2 public usage metrics (e.g., daily calls, signups).

Fail: Emissions ≤0.20% with flat/negative 30‑day trend and no usage telemetry.

Access (distribution)

Pass: At least 2 integrations where target users already are (e.g. LangChain/Agents, app stores/marketplaces, CI/CD platforms) or a signed pilot with a real user cohort.

Fail: Only social media hype; no integrations, no pilots.

Liquidity/Stake (supply‑side confidence)

Pass: Active validator interest (public updates, weights rationale), stable miner count over 30 days.

Fail: Miner churn; validator silence; weights volatile without communications.

Sustainability (unit economics)

Pass: Clear pricing that compares favorably to a centralized competitor on one dimension (price, speed, privacy) with a path to paid.

Fail: No pricing; “free forever”; or pricing hidden behind “DM us.”

Why these lines? Subnets below 0.20% emissions are typically bottom quartile and struggle to survive churn without rapid distribution gains.

Two integrations prove discoverability beyond socials and convert curiosity into usage. Treat these as heuristics and adjust for category fit if you’re in a niche.

Score: 5–6 passes = Saveable now. 3–4 = Conditional (focus on fails). ≤2 = Let it sunset or pivot.

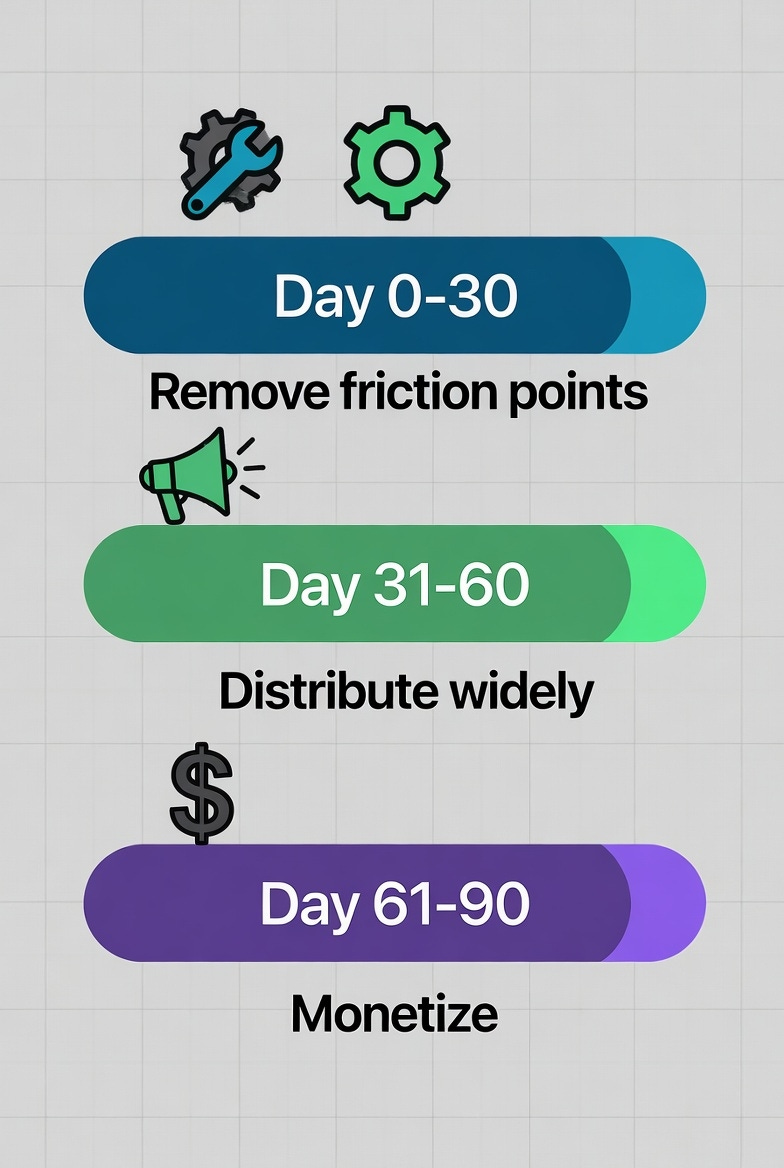

RALLY: the 30‑60‑90 day rescue sprint

Day 0–30: Remove friction

One‑line pitch rewrite. Ship homepage hero + 15‑second explainer.

Launch a no‑login demo or “Try it now” endpoint.

Publish pricing vs. two incumbents with one clear wedge.

Add 2 category‑fit integrations (e.g., LangChain tool/Agent plugin for AI builders; app store listing/marketplace tile for consumer apps; Vercel/Cloud templates for devs).

Weekly public updates with 3 metrics: unique users/calls, emissions share, miner/validator count.

Day 31–60: Earn distribution

Land 2 distribution partners (marketplaces, SaaS plugins, OSS repos) with co‑marketing.

Ship 2 proof‑of‑value case studies with metrics (e.g., $/1k calls, latency, accuracy).

Convert demo to freemium with usage caps; enable card checkout (no TAO required).

Day 61–90: Lock in and monetize

Launch one “flagship workflow” with an opinionated template that returns time/money saved.

Incentivize validator alignment: publish weights logic cheat‑sheet and performance dashboards; host one validator AMA.

Aim for emissions ≥0.30% (roughly top half) or ≥2x 30‑day usage; ≥10% free‑to‑paid conversion on active users.

Guardrail: If VITALS Score ≤2 after Day 30, consider sunsetting/pivoting rather than dragging through 90 days.

Pressure test: VITALS + RALLY on HappyAI (SN103)

As an illustrative run‑through, let’s apply the framework to HappyAI (SN103), who as of writing is in the bottom three on the list of subnets for deregistration.

Their core offering is an AI mental-health companion called Avocado, accessed through a mobile app.

This is a hypothetical diagnostic based on public materials; here’s exactly what I would verify this week and how I’d decide.

VITALS diagnostic (snapshot)

Value signal: Fail. Public messaging like “build an AI app to make people happier” is too vague. Users need one outcome.

Interface: Fail. The website seems in a state of indecision as to whether to promote their token on Base, their Avocado mobile app or explain their history. There is a separate website for the avocado app which confuses things. The avocado app also requires an install and a subscription for full access.

Traction: Conditional. Emissions around 0.14% implies weak demand. However, usage statistics are on the up as reported by the team on social media.

Access: Pass. Available on app stores and integrated with Bittensor for decentralized features; with pilots via trial users.

Liquidity/Stake: Pass. Validators are active and communicative, miner count is stable with no signs of churn or validator silence.

Sustainability: Pass. Subscription model compares favorably on price (affordable mental health AI vs. traditional therapy). Privacy/speed compares favorably via decentralization.

Score: 3/6 → Focus on value signal and interface to highlight the value add for users. If emissions don’t improve with distribution, consider a narrower wedge or pivot.

RALLY plan for HappyAI

Days 0–30

Rewrite homepage hero + 10‑second explainer focused on one outcome: “Avocado: Your pocket AI therapist for daily mental health support, powered by decentralized tech for privacy.”

Launch No-Login Demo: Build web-based chat simulator on Replit (e.g., sample AI therapy session); link from site for <60s result. Tease advanced features gated in app.

Publish Pricing vs. Incumbents: $4.99/month for premium (3D, unlimited). Compare: “Cheaper than Headspace, with Bittensor privacy.”

Add category fit Integrations: App store optimization checklist; mental‑health content partners.

Days 31–60

Land 2 Distribution Partners: employer wellness pilot (small cohort); clinician referral pilot (non‑diagnostic use). Publish clear data boundaries.

Ship 2 Case Studies: 1) latency/cost comparison vs. incumbents 2) pilot with 50 users: Metrics on mood tracking accuracy. Share as blogs.

Days 61–90

Launch One Flagship Workflow: “2‑Minute Reset” with measurable outcome (completion rate, time saved).

Host validator AMA; publish weights logic cheat‑sheet.

Targets: emissions ≥0.30% or 2x 30‑day usage; ≥10% free‑to‑paid conversion.

A battle plan for subnets at risk

Story and positioning: Pitch to the communities you’re disrupting, not just validators/miners. Align with open‑source values and write one sentence a non‑technical user can repeat.

UX and pricing clarity: Ship a no‑login front end; publish a pricing table vs. two incumbents with one wedge.

Distribution: Ship integrations where users already are (marketplaces, app stores, dev tools) with runnable examples in minutes.

Marketing operations: Weekly public updates with usage and emissions; two case studies by Day 60.

Investor signaling: Publish weights logic notes and validator dashboards; host one validator AMA.

Be ready: Use the deregistration immunity period to nail positioning before chasing hype.

Why This Matters for Your Bittensor Journey (And Mine)

Deregistration keeps Bittensor lean. But losing promising subnets prematurely is waste.

If you’re in the relegation zone ahead of halving, run them through the VITALS framework. If you pass three or more, you’re saveable. Use RALLY as a guide to help kick on from there.

I want to improve this framework with operator reality rather than armchair theory. How can it improve and what actually moves the needle when the stakes are on the line?

Tell me what’s missing here so I can refine the metrics and gates.

Until next time.

Cheers,

Brian